ZenHR’s payroll management system is purpose-built payroll software for Saudi Arabia and the MENA region. It centralizes employee data, timesheets, and benefits to calculate gross-to-net pay, generate statutory reports, and keep every cycle accurate and on time, without spreadsheets. ZenHR goes further with native compliance and integrations in KSA with Mudad, Muqeem, and GOSI, and full localization for WPS, social security, and tax rules across the MENA region.

What you will get:

.webp)

ZenHR’s Cost Center Management feature helps HR and finance teams accurately allocate payroll costs across departments, projects, and work locations. Integrated with ZenHR’s payroll system, it automates cost distribution, tracks employee contributions, and provides detailed cost center reports for smarter budgeting and workforce planning. Fully localized for Saudi Arabia and the MENA region, this feature ensures compliance with GOSI and labor regulations while improving payroll accuracy and financial visibility.

ZenHR supports multi-payroll processing through flexible multi-branch configurations and payroll-by-entity setups. This allows companies operating across different branches, locations, or legal entities to run separate payroll cycles with localized rules, salary structures, and compliance settings. ZenHR delivers full functionality for managing complex payroll operations across teams and jurisdictions, ideal for businesses in Saudi Arabia and the wider MENA region.

ZenHR’s payroll features are built for MENA payroll compliance, offering automated GOSI, WPS, social insurance, and income tax calculations based on your country’s regulations. Generate accurate, government-ready reports using official templates and stay compliant with evolving labor and tax laws. With fully localized payroll reporting and customizable formats, ZenHR ensures error-free submissions, supports audits, and simplifies end-to-end payroll management across the region.

.webp)

Easily manage employee overtime with a built-in self-service flow that lets team members submit requests for extra hours worked. Managers can approve or reject requests directly, while HR can choose how to compensate, either through paid overtime or additional time off. You can also set up custom overtime rules with multiple rates based on day type, shift, or duration to ensure accurate calculations and full labor law compliance across the MENA region.

Make it easy for employees to submit expense requests for things like travel per diem, transportation, or work-related purchases they paid for out of pocket. Each request goes through a custom approval workflow, so managers and finance teams can review and approve before processing payments.

Give employees instant access to their health insurance details through a clear, self-service experience. They can view coverage for themselves and their dependents, while HR and payroll teams automatically manage health insurance deductions. This feature supports flexible, employer-covered benefits and ensures compliance with local regulations.

Track time, manage budgets, and keep your projects on schedule with ZenHR’s built-in project tracking tools. Employees can log hours spent on projects, tasks, activities, or job sites, while managers get access to detailed timesheet reports for better planning and cost control. This feature helps you stay within budget, improve accountability, and streamline time tracking and project management across your organization.

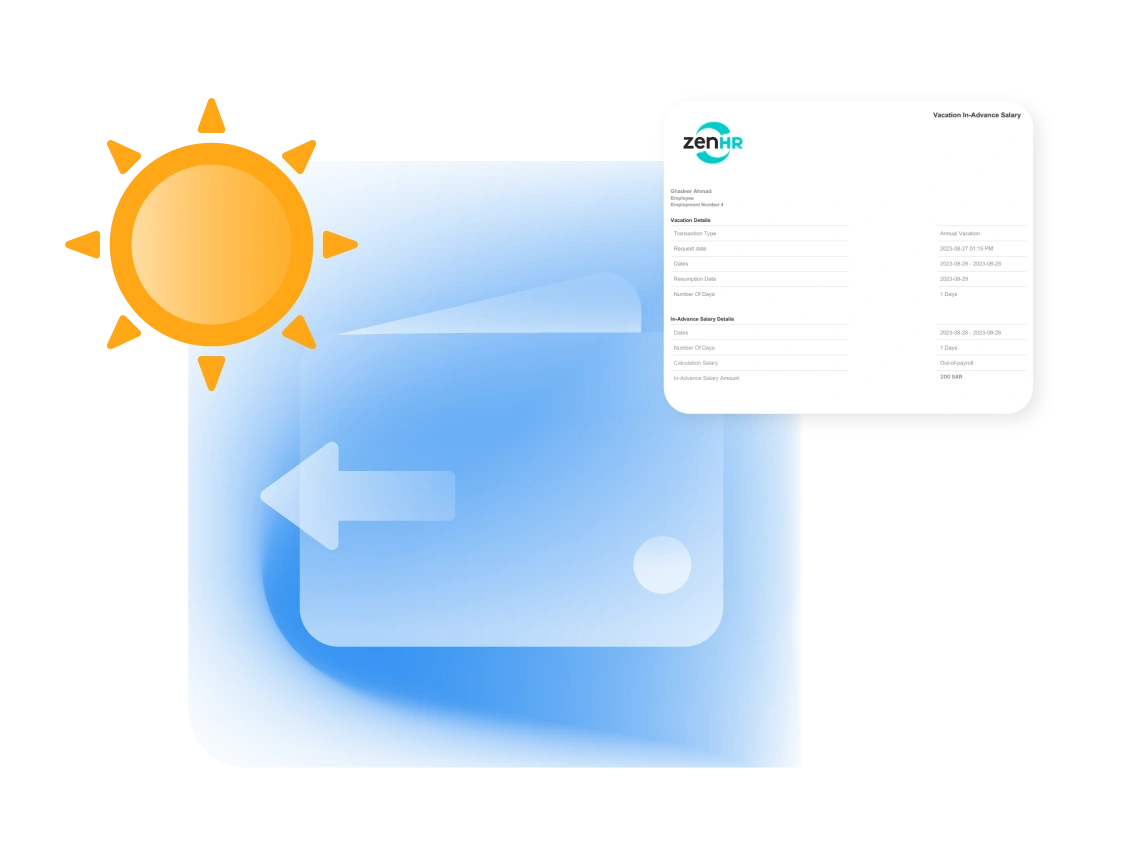

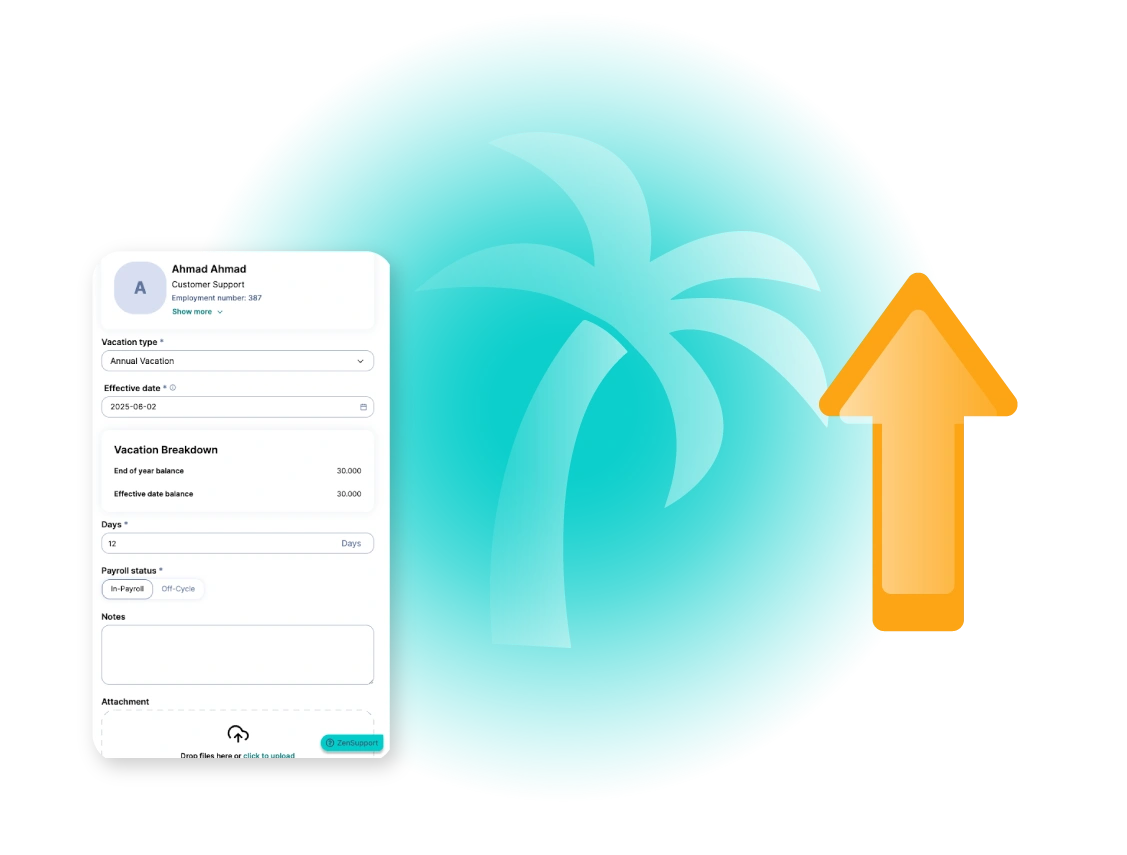

Easily process early salary payments for employees going on vacation, whether for the current month or multiple months ahead. ZenHR automatically calculates vacation-in-advance salary based on prorated allowances, deductions, and GOSI contributions, ensuring full accuracy and compliance. You can also set up automated reminders for employee return dates to keep operations running smoothly.

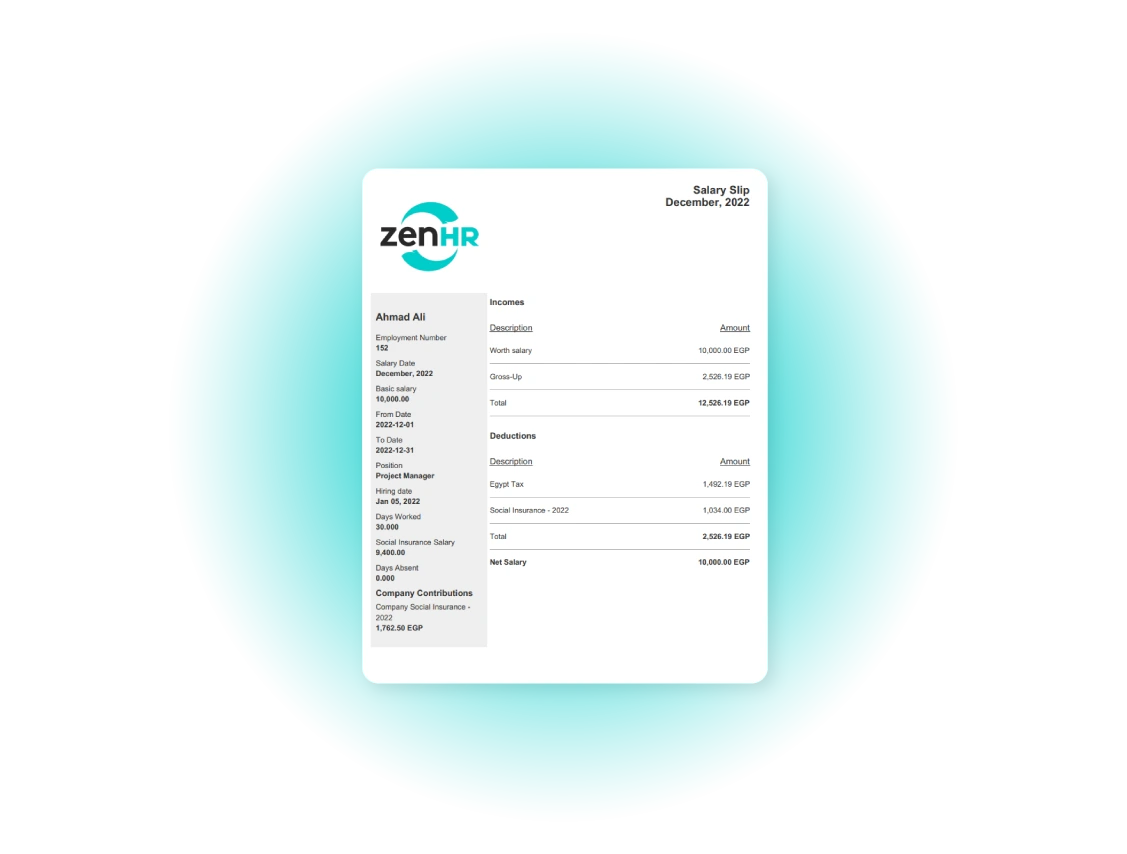

Simplify payroll calculations in Egypt with ZenHR’s Gross-Up Salary Calculator. Determine the gross salary needed to ensure employees receive a fixed net salary after taxes and social insurance deductions. It automatically accounts for Egyptian tax brackets, employee and employer social insurance contributions, and other local regulations, making it easier to offer tax-inclusive packages while staying fully compliant with Egyptian labor laws.

Stay compliant and financially prepared with ZenHR’s automated provisions calculator. Whether it’s severance pay, gratuity, or leave entitlements, this feature lets HR and finance teams track and calculate employee provisions in real time, improving payroll planning and budget forecasting.

Streamline your organization’s expense management with ZenHR. The Company Expenses tool allows you to record operational costs, allocate them to cost centers, and generate detailed reports, helping finance teams monitor budgets and stay audit-ready.

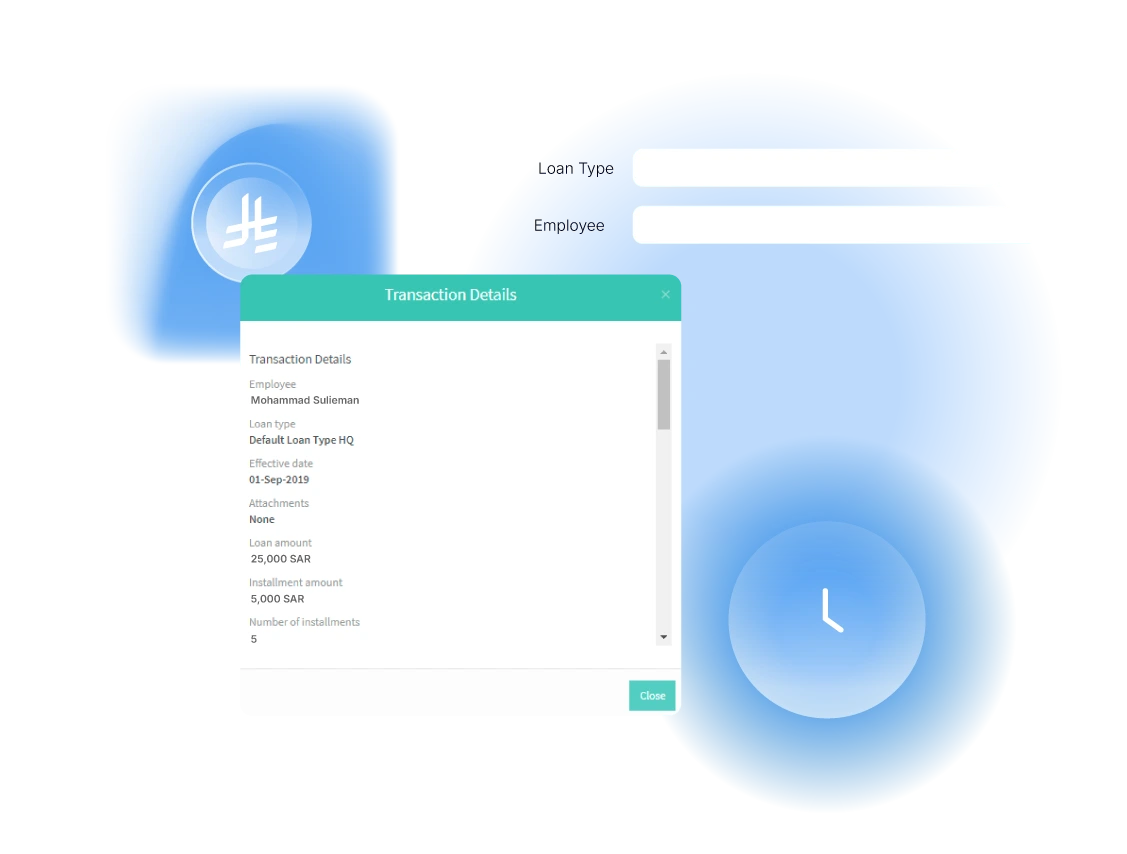

Manage employee loans with accuracy and ease through ZenHR’s Loan Management feature. HR teams can create, track, and approve employee loan requests, set repayment schedules, and automate monthly salary deductions. The system ensures full visibility over remaining balances and integrates with payroll to streamline financial tracking and maintain compliance with company policies.

Ensure payroll compliance with ZenHR’s built-in support for the Wage Protection System (WPS) and bank salary transfer templates. This feature allows you to generate country-specific WPS files and export salary transfer reports in the required formats for your bank. Stay compliant with local labor laws while automating secure, on-time salary payments across your organization.

Automate your payroll accounting process by exporting payroll journal entries from ZenHR directly into leading accounting software like QuickBooks, SAP, Xero, and NetSuite. This integration-ready feature helps finance teams streamline payroll reconciliation, reduce manual entry errors, and ensure accurate, real-time financial reporting.

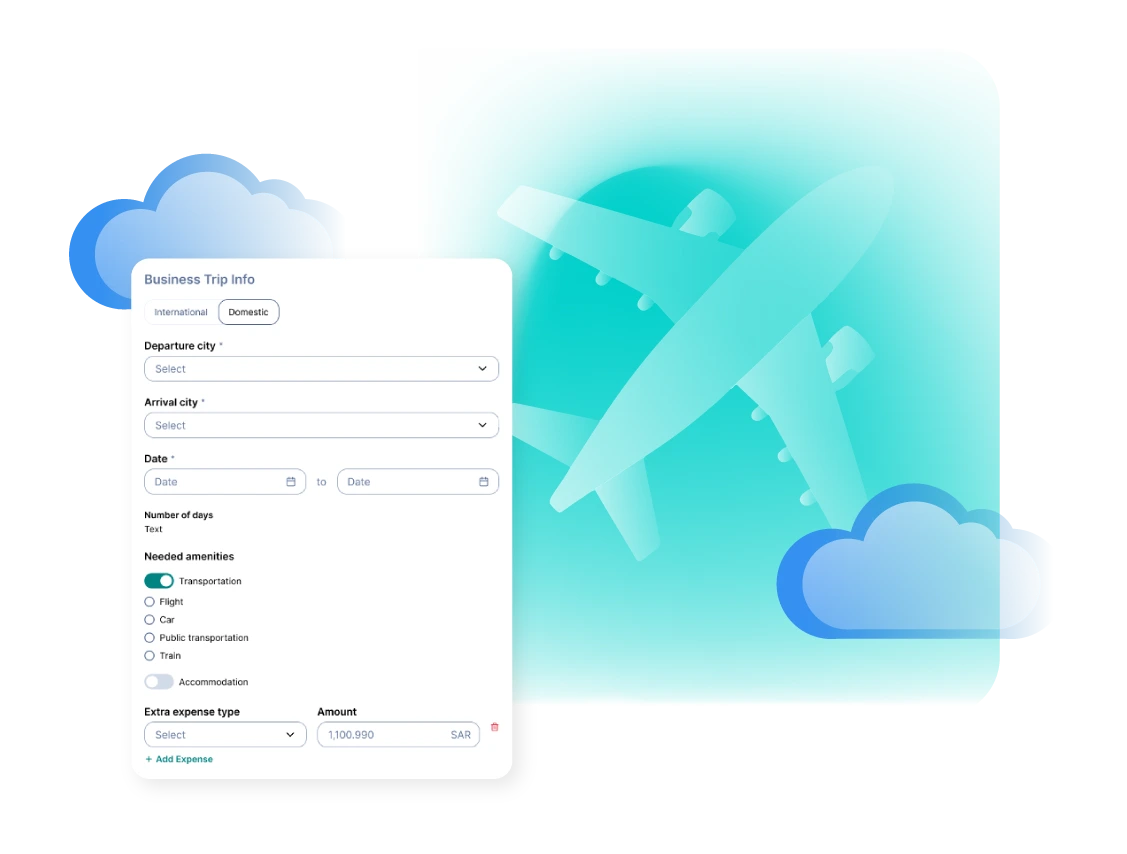

Manage employee business trip requests from start to finish with ZenHR’s Business Travel feature. Employees can submit travel plans, including destination, dates, and purpose, while managers handle approvals and budget reviews through a structured workflow. HR teams can track travel expenses, monitor policy compliance, and keep all travel-related data in one place.

Calculate accurate end-of-service benefits (ESB) and termination payouts with ease. ZenHR automates gratuity calculations, final settlements, and deductions based on your country’s labor laws, including notice periods, unused leave, and service duration. This feature ensures full compliance, reduces manual errors, and supports a smooth offboarding process for HR and payroll teams managing employee terminations.

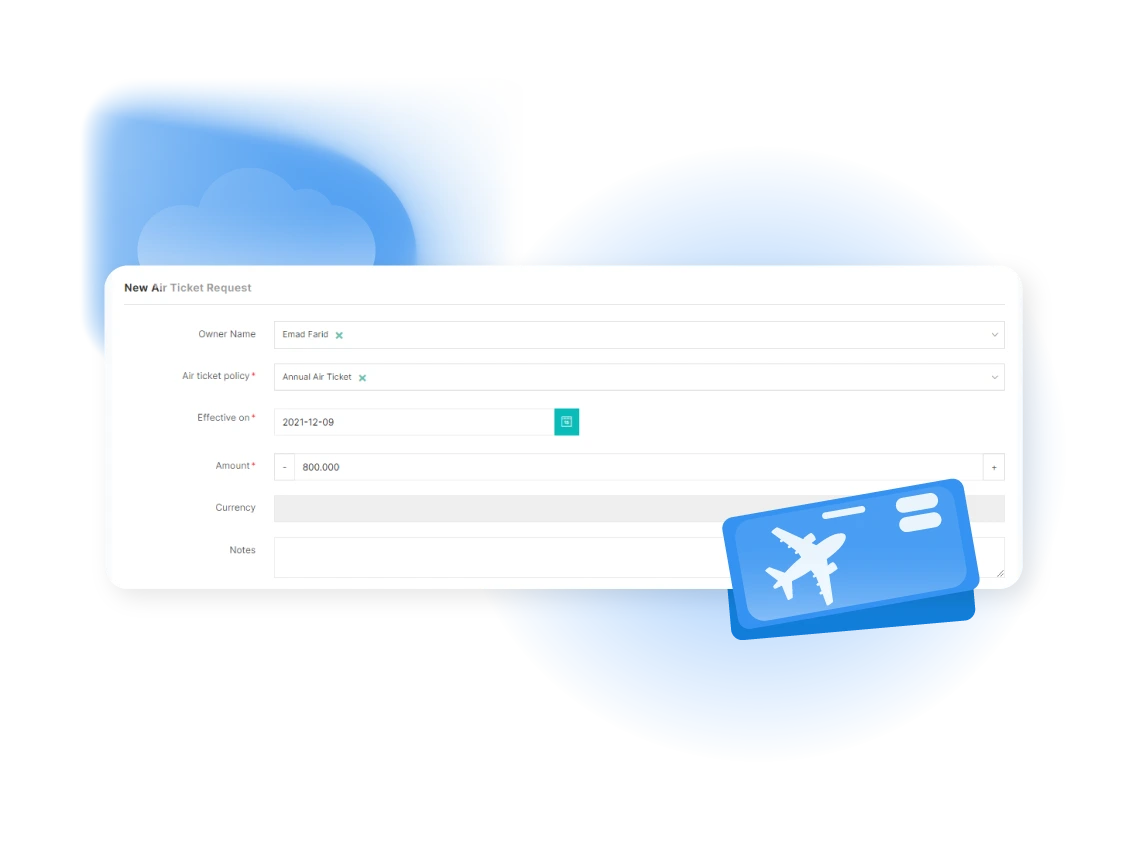

Manage employee air ticket entitlements with ease using ZenHR’s Air Tickets feature. Employees can submit ticket requests based on company policy, while HR can track eligibility, approve tickets, and automate ticket allowances during annual leave, relocation, or repatriation. This feature ensures full compliance with travel policies, improves visibility, and simplifies the management of employee travel benefits.

Allow eligible employees to request early encashment of their Service Termination Benefits (STB) directly through ZenHR’s self-service portal or mobile app. HR and finance teams can configure rules, set eligibility conditions, define encashment limits, and manage approvals, ensuring compliance with labor laws and seamless payroll integration. This feature helps organizations offer added flexibility while maintaining full control over end-of-service benefit payouts.

Allow employees to request the encashment of unused vacation days through ZenHR’s self-service platform. HR can configure eligibility rules, define limits, and route requests through a customizable approval workflow. Once approved, payouts are automatically reflected in payroll, ensuring accurate calculations and full compliance with labor laws.

Standardize and streamline employee compensation with ZenHR’s Salary Package Templates. HR teams can create pre-defined templates that include basic salary, allowances, deductions, and benefits, ensuring consistency across roles and departments. This feature speeds up onboarding, supports payroll accuracy, and helps maintain compliance with your company’s salary structure policies.

Find quick answers to common questions about ZenHR’s features, setup, and support.

ZenHR is localized for KSA and the wider MENA region, with built-in support for WPS and integrations that streamline compliance (e.g., Mudad for WPS files, GOSI for social insurance, and Muqeem for residency workflows). This means fewer manual uploads, fewer errors, and faster, compliant payroll runs every cycle.

Yes. Direct integrations allow you to generate and transmit WPS-ready payroll files (Mudad), synchronize social insurance contributions (GOSI), and handle expat-related processes (Muqeem) without leaving ZenHR. This reduces risk and ensures payroll remains aligned with current regulations.

ZenHR automates WPS file creation and validation for Saudi Arabia and keeps records audit-ready. With recent enforcement updates, authorities are actively monitoring salary delays and deductions via Mudad—so having WPS automation within your payroll system helps you stay compliant and inspection-ready.

Yes. Employees can request overtime, advances (e.g., vacation advance salary), and reimbursements through self-service. Approved items flow directly into payroll calculations, saving HR time while maintaining a full audit trail.

Yes. ZenHR supports multi-branch and multi-entity processing with country-specific rules and multi-currency options. You can run localized cycles while consolidating data across regions—ideal for organizations scaling across the GCC and MENA.

Yes. ZenHR offers plug-and-play integrations with popular accounting and ERP platforms (e.g., QuickBooks, Xero, SAP Business One/ByDesign, NetSuite, Microsoft Dynamics 365, and Odoo). This ensures seamless payroll journal entries and eliminates duplicate data entry between HR and Finance.

They’re often used interchangeably. In practice, you need a system that automates calculations, enforces compliance, and centralizes workflows. ZenHR’s payroll management system delivers all of these, purpose-built for KSA and MENA, with WPS, GOSI, and Muqeem in mind.

Try ZenHR to unify payroll processing, compliance, and reporting — all in one easy-to-use platform.